Google Alternatives: 15 Search Engines You Can Try In 2026

Google has 85 to 98 billion visits per month, but that number is decreasing. Discover 15 top Google alternatives in 2026 that could best serve your needs.

Google Alternatives: 15 Search Engines You Can Try in 2026

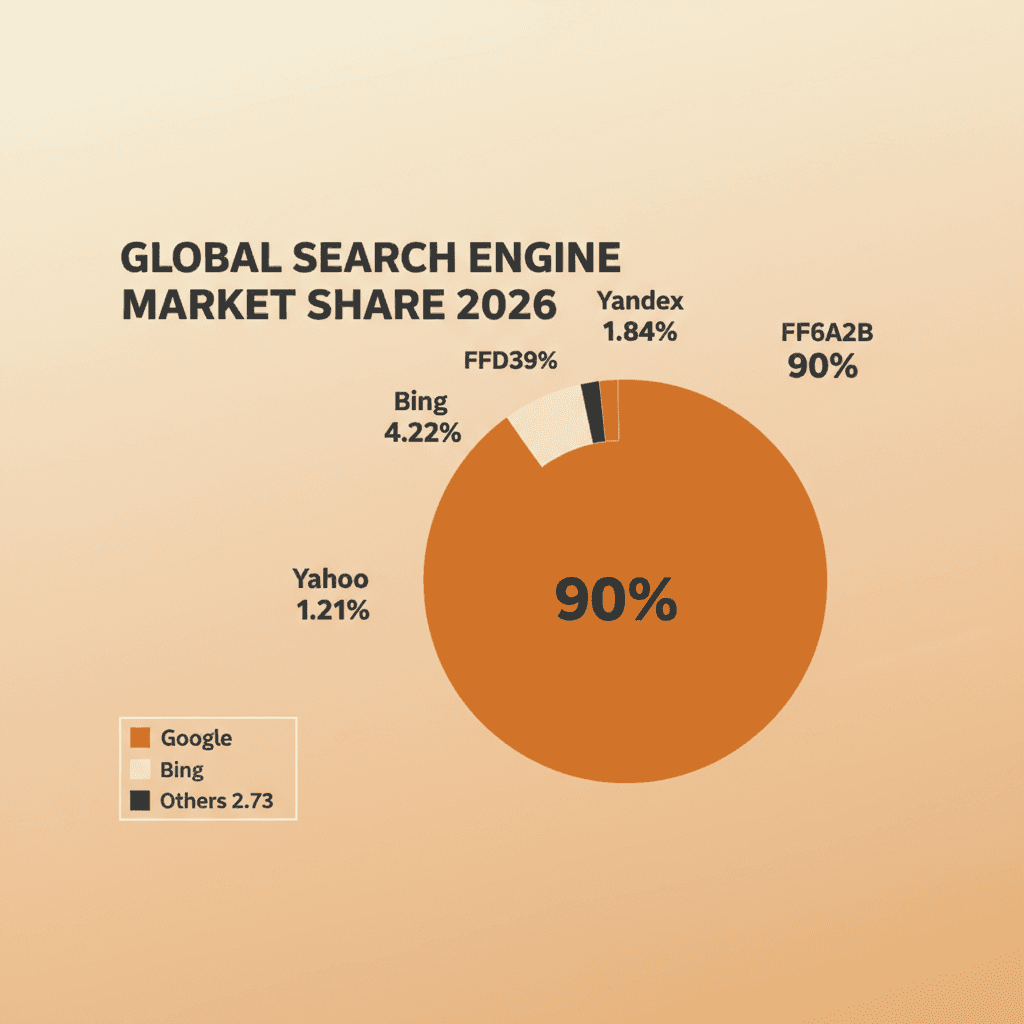

Google dominates 90% of global search traffic, but alternatives are gaining ground fast. From privacy-first engines that don't track your data to AI-powered platforms delivering conversational answers, 2026's search landscape offers genuine choices for users tired of surveillance capitalism or seeking specialized results.

This guide examines 15 viable Google alternatives, their market share, monthly users, and unique features to help you find the right tool for your needs.

We've all been there. You're typing into Google for the hundredth time today, and it hits you: maybe there's another way. You know Google owns 90% of search traffic, but that also means 10% of billions of daily searches happen elsewhere. Those aren't just stragglers; they're privacy advocates, regional users, AI enthusiasts, and people who want search results that aren't shaped by their entire browsing history.

The truth is, Google's near-monopoly faces its first real pressure in two decades. As of 2026, Google's global market share sits at 90.04%, down from 92.58% in 2022. Microsoft Bing climbed to 4.22%, DuckDuckGo processes 100 million daily searches, and new AI-native engines like Perplexity handle 30 million queries daily. The search market is fragmenting, and your next search doesn't have to go through Mountain View.

This article breaks down 15 Google alternatives you can actually use in 2026. No fluff. Just monthly user counts, key features, privacy policies, and honest assessments of what each engine does best.

Why Google Still Dominates (And Why That's Changing)

Let's start with the numbers that matter.

Google processes approximately 5 trillion searches annually, or about 13.7 billion searches per day. That works out to roughly 99,000 queries per second. The search engine's dominance stems from three factors: default browser placement, superior algorithmic accuracy, and ecosystem lock-in through Android, Chrome, and Gmail.

But here's where it gets interesting. A Wharton study published in 2025 found that when users were paid to try Bing for four weeks, 33% chose to keep using it afterward. The reason? Most people never explore alternatives, not because Google is unbeatable, but because switching requires effort.

The Three Forces Reshaping Search in 2026

Privacy backlash: Two-thirds of U.S. citizens see more risks than benefits in corporate data collection. Privacy-focused engines grew steadily, with DuckDuckGo hitting 100 million daily searches and Brave Search processing 50 million queries daily from its independent 30-billion-page index.

AI integration: ChatGPT processes over 1 billion queries daily with 800-900 million weekly active users. Perplexity reached 30 million daily queries. Traditional search is morphing into conversational answer engines that synthesize information rather than just linking to it.

Regional dominance: Google's global average hides massive variance. In Russia, Yandex commands 76.3% market share. In China, Baidu holds 54.36%. In the U.S., Google's share dropped from 87.39% in 2024 to 85.07% in 2026 as Bing, Yahoo, and DuckDuckGo all gained ground.

The search monopoly isn't breaking overnight, but the cracks are real.

Why People Are Looking for Google Alternatives in 2026

You're not alone if you're exploring other options. Here's what drives the shift:

Privacy Concerns Top the List

Traditional search engines track and monetize your data. Google builds detailed profiles linking searches to your identity, location, and browsing habits. For users who value privacy, this trade-off no longer feels acceptable. Privacy-focused alternatives don't personalize results based on your history, which means you see the same results as everyone else—but your searches remain truly anonymous.

Specialized Results Beat Generic Links

Platform-specific engines often deliver more relevant results for specific needs. If you're researching a product purchase, Amazon's results prove more useful than Google's. For developer documentation, Stack Overflow beats generic web results. YouTube functions as the world's second-largest search engine by query volume, handling how-to searches better than text-based alternatives.

Algorithm Fatigue and AI-First Answers

Independent engines offer different perspectives and ranking systems. Brave Search operates from its own index, not Google or Bing results with a privacy wrapper. AI-native platforms like Perplexity and ChatGPT deliver synthesized answers with citations, not just blue links to click through. For research tasks, this saves hours.

Lower Ad Costs for Advertisers

Most marketers ignore Bing completely, missing out on 100 million daily active users and 30% lower advertising costs than Google. Bing processes 1.2 billion searches daily and delivers $15.6 billion in ad revenue. The platform's AI integration drove 21% year-over-year growth in search advertising while offering better click-through rates than competitors.

The best search engine depends entirely on what you actually value: privacy, specialized results, conversational AI, or advertising efficiency.

The 15 Best Google Alternatives in 2026

Here's the complete breakdown of viable alternatives, with real data on monthly users, market share, and what each engine actually does well.

1. Microsoft Bing

Monthly Users: 3.357 billion monthly visits

Market Share: 4.22% globally, 8.78% in the U.S., 11.96% on desktop

Bing is Google's closest competitor and the only alternative with meaningful scale. Microsoft's search engine processes 900 million daily searches and serves over 100 million daily active users. Revenue from search and news advertising hit $15.6 billion in fiscal year 2026.

Key Features:

Copilot AI integration: Bing became the first search engine to implement generative AI for search in 2023. Copilot has 100 million daily active users and ranks as the fourth most-used AI chatbot globally.

Rewards program: Accumulate points while browsing that you can spend in Microsoft and Windows stores.

Visual search excellence: Bing's image and video search capabilities outperform Google, with no YouTube bias skewing video results.

Lower ad costs: Cost-per-click averages 30% lower than Google Ads, with higher engagement rates.

Bing's market share climbed from 3.51% to 4.61% between 2024 and 2025, driven entirely by AI integration. The platform holds 54.68% of console search traffic, making it dominant in Xbox and gaming contexts.

Best For: Users who want AI-powered answers, Windows ecosystem integration, and advertisers seeking better ROI than Google Ads.

Pros:

Second-largest search engine with real scale

AI Copilot delivers conversational answers with citations

Rewards program adds tangible value

Strong visual search capabilities

Cons:

Still relies heavily on Google's market to set baseline expectations

Default status on Windows doesn't translate to loyalty

Privacy policies similar to Google's tracking model

2. DuckDuckGo

Monthly Users: 100 million daily searches (approximately 3 billion monthly)

Market Share: 0.54% globally, 1.96% in the U.S., 2.37% in U.S. mobile

DuckDuckGo is the privacy-first search engine that doesn't track users or store search history. Founded in 2008, it hit 1 billion searches in 2013 and now processes roughly 100 million daily searches. The platform holds 0.54% global market share, making it the fifth most popular search engine worldwide.

Key Features:

Zero tracking: No search history storage, no IP address logging, no cookies following you around the web

Uniform results: Everyone sees the same results for the same query—no personalization based on your profile

Privacy tools suite: Browser extensions block third-party trackers, force HTTPS connections, and provide privacy grades for websites

Email protection: @duck.com addresses forward to your real inbox without tracking

App tracking protection: Android users can block trackers across all apps, not just the browser

DuckDuckGo's mobile browser ranks among the top 200 apps on Google Play with a 4.8-star rating. The Chrome extension has over 6 million users. In the U.S., it ranks as the second most popular mobile search engine after Google.

Best For: Privacy-conscious users who want anonymous search without surveillance capitalism.

Pros:

Complete privacy with no tracking whatsoever

Clean, ad-light interface

Strong mobile presence with highly-rated apps

Privacy tools extend beyond search to email and app tracking

Cons:

Results powered partly by Bing, not fully independent index

Less comprehensive than Google for obscure queries

No personalization means you can't refine results based on preferences

3. Yahoo Search

Monthly Users: 2.75 billion monthly searches

Market Share: 1.21% globally, 3.13% in the U.S.

Yahoo was the most popular search engine in 1998, commanding 95 million daily page views. Today it's powered by Bing, meaning you see Bing's results with Yahoo's interface. The platform handles approximately 2.75 billion searches monthly, or about 64,000 searches per minute.

Yahoo captures 10.7% of all U.S. internet searches when including its full Verizon Media umbrella. The homepage functions as a complete web portal with news, finance, sports, and mail—making it more than just search.

Key Features:

Integrated web portal: Access news, stocks, weather, and email from the same interface

Yahoo Mail: 225 million active users, processing over 25 billion emails daily

Yahoo Finance: 93 million U.S. monthly visitors make it the top finance site globally

Yahoo News: 180 million U.S. monthly visitors, with 88% considering it reliable

Sports content: Yahoo Sports dominates fantasy sports, voted best fantasy app for five consecutive years

Yahoo users are more likely to click search results—29.7% of searches generate clicks compared to Google's 8.43%. The audience skews younger than expected, with 60% of 18-24 year-olds using Yahoo at least monthly.

Best For: Users who want a full web portal homepage, finance tracking, sports scores, and email in one place.

Pros:

Rich homepage with news, finance, and entertainment

Strong email platform with loyal user base

Higher click-through rates than Google

Excellent finance and sports verticals

Cons:

Search results are just Bing with different branding

No unique search technology or innovation

Privacy policies similar to mainstream tracking

4. Yandex

Monthly Users: 61.2 million monthly users in Russia

Market Share: 1.84% globally, 76.3% in Russia

Yandex is Russia's answer to Google, holding 76.3% domestic market share—3x more popular than Google in its home market. Globally it captures 1.84% of searches, making it the third-largest search engine worldwide.

Yandex operates across 230+ countries and 100+ languages, with heavy investment in machine learning and AI. The platform offers maps, translation, email, cloud storage, and ride-hailing services alongside search.

Key Features:

Regional dominance: Commands over 75% of Russian search traffic

Yandex Alice: AI-powered voice assistant delivering contextual responses and personalized interactions

Machine learning focus: Advanced algorithms optimized for Cyrillic languages and regional content

Full ecosystem: Maps, taxi service, email, cloud storage, music streaming

Translation tools: Superior accuracy for Russian, Ukrainian, and Eastern European languages

Yandex holds the fastest-growing market share among major engines, quadrupling its global presence over five years. The platform processes billions of searches monthly in regions where Google struggles with local language nuances.

Best For: Russian speakers, Eastern European markets, and businesses targeting non-English audiences.

Pros:

Unmatched accuracy for Russian language searches

Dominant in its core market with real scale

AI voice assistant rivals Western alternatives

Comprehensive ecosystem beyond just search

Cons:

Limited relevance outside Russian-speaking regions

Corporate restructuring and geopolitical tensions create uncertainty

Privacy policies align with Russian data laws

5. Baidu

Monthly Users: Dominant in China with 54.36% market share

Market Share: 0.76% globally, 54.36% in China

Baidu is China's leading search engine, commanding over half of the mainland market where Google is blocked. While its global share appears small at 0.76%, within China it processes the majority of searches for 1.4 billion people.

The platform handles Chinese language searches better than any alternative, with superior understanding of regional dialects, local businesses, and government-approved content.

Key Features:

Chinese language optimization: Unmatched accuracy for Mandarin searches and local content

Regional services: Maps, food delivery, ride-hailing, cloud storage

AI investment: Heavy machine learning integration across search and services

Mobile dominance: Over 80% market share in China's mobile search

Local business: Essential for any company targeting Chinese consumers

Baidu's market share fluctuated over the past decade but never fell below 0.75% globally. Within China, it remains the default search engine despite competition from Sogou and other domestic players.

Best For: Businesses targeting Chinese markets, Mandarin speakers, and anyone needing China-specific information.

Pros:

Dominant in world's largest internet market

Superior Chinese language processing

Essential for China SEO and business

Strong mobile presence

Cons:

Irrelevant outside China

Subject to government censorship and content filtering

Limited English language support

6. Brave Search

Monthly Users: 50 million daily queries

Market Share: Growing independent player

Brave Search operates from its own 30-billion-page index—not Bing or Google results with a privacy wrapper. This makes it one of the few truly independent search engines launched in the past decade.

The platform blocks trackers by default, doesn't profile users, and delivers unbiased results without filter bubbles or personalization.

Key Features:

Independent index: 30 billion pages crawled by Brave's own technology

Zero tracking: No user profiling, no search history storage

Goggles feature: Users can re-rank results using community-created filters

Brave Rewards: Earn crypto for viewing privacy-respecting ads

Anti-tracking browser: Full ecosystem including browser, search, and crypto wallet

Brave Search processes 50 million queries daily as of 2026. The platform appeals to users who want privacy without sacrificing independence—DuckDuckGo relies on Bing, but Brave builds its own index.

Best For: Users who prioritize both privacy and independence from Google/Bing infrastructure.

Pros:

Truly independent index, not reskinned Bing

Strong privacy protections with no tracking

Goggles allow customization without personalization

Growing rapidly among tech-savvy users

Cons:

Smaller index means some queries return fewer results

Less comprehensive than Google for obscure topics

Crypto integration polarizes some users

7. Ecosia

Monthly Users: Millions of monthly users (specific traffic not disclosed)

Market Share: Growing in Germany and France

Ecosia donates 100% of its profits to tree-planting and reforestation projects. The search engine has funded over 150 million trees planted worldwide since launch in 2009.

Results are powered by Bing, but the business model focuses on environmental impact rather than privacy. Ecosia tracks enough data to serve ads but commits to transparency about what's collected.

Key Features:

Tree planting: Profits fund reforestation in 30+ countries

Carbon negative: Removes more CO2 than it produces

Financial transparency: Publishes monthly reports on revenue and tree counts

Privacy focus: Doesn't sell data to third parties, anonymizes searches within one week

Solar-powered: Servers run on renewable energy

Ecosia appeals to environmentally-conscious users who want search to contribute positively. It's particularly popular in Germany and France, where green values drive consumer choices.

Best For: Environmentally-conscious users who want their searches to fund tangible environmental projects.

Pros:

Clear environmental impact with transparent reporting

Carbon-negative operations

Privacy protections better than Google

Growing European user base

Cons:

Search results are just Bing

Some tracking required for ad revenue

Environmental claims require trust in reporting

8. Startpage

Monthly Users: Not publicly disclosed

Market Share: Privacy-focused niche player

Startpage calls itself "the world's most private search engine." Founded in 2006 in the Netherlands, it delivers Google search results without Google's tracking. The platform acts as an anonymous proxy, submitting your queries to Google without revealing your identity.

Key Features:

Google results without tracking: See Google's search results anonymously

Anonymous View: Browse websites through Startpage's proxy to hide your IP

No tracking systems: Doesn't record IP addresses or use cookies

European privacy: GDPR compliant, headquartered in Netherlands

Custom settings: Configure filters and preferences without logging in

Startpage offers the best of both worlds: Google's comprehensive results with complete privacy. You sacrifice personalization but gain anonymity.

Best For: Users who want Google's search quality without surveillance.

Pros:

Google results with complete privacy

Anonymous View feature hides identity from destination sites

GDPR compliant European operation

No tracking or profiling

Cons:

Still dependent on Google's index

Slower than searching Google directly

Anonymous View can break some website functionality

9. Qwant

Monthly Users: 10+ million monthly users (primarily European)

Market Share: European privacy-focused player

Qwant is a French search engine emphasizing privacy and neutrality. It doesn't track users or personalize results, delivering the same answers to everyone. The platform operates under strict European privacy regulations.

Key Features:

European privacy: GDPR compliant, no tracking

Neutral results: No filter bubble or personalization

Qwant Junior: Child-safe search filtering inappropriate content

Music search: Dedicated vertical for finding songs and albums

Maps integration: Own mapping service competing with Google Maps

Qwant uses Bing's index but adds its own crawling and ranking. The platform focuses on European markets where privacy regulations are strictest.

Best For: European users seeking privacy-first search with GDPR protection.

Pros:

Strong European privacy protections

No tracking or personalization

Child-safe search option

Independent European operation

Cons:

Limited adoption outside Europe

Results partially dependent on Bing

Smaller index than major players

10. Perplexity AI

Monthly Users: 30 million daily queries

Market Share: Leading AI answer engine

Perplexity represents the future of search: conversational AI that synthesizes information rather than just linking to sources. The platform processes 30 million queries daily, delivering direct answers with citations instead of blue links.

Perplexity combines large language models with real-time web search, providing up-to-date information in natural language.

Key Features:

Conversational answers: Natural language responses instead of link lists

Source citations: Every claim includes clickable sources

Follow-up questions: Thread conversations to dig deeper

Pro mode: Access to advanced models like GPT-4 and Claude

Mobile apps: iOS and Android with voice input

Perplexity appeals to users who want synthesized information, not pages to read. For research tasks, it saves hours of clicking through results.

Best For: Research, learning, and users who prefer conversational interaction over traditional search.

Pros:

Direct answers save time

Source citations maintain transparency

Conversational interface feels natural

Real-time web access keeps information current

Cons:

Can hallucinate or misinterpret sources

Pro features require subscription

Not ideal for navigational searches

11. Swisscows

Monthly Users: Not publicly disclosed

Market Share: Privacy-focused niche player

Swisscows is a privacy-focused search engine based in Switzerland, operating under strict Swiss data protection laws. The platform doesn't track users, store data, or serve personalized ads.

Swisscows uses semantic information recognition to deliver relevant results without profiling users. It's particularly popular among families due to built-in family-friendly filtering.

Key Features:

Swiss privacy: Operates under Switzerland's strict data laws

Zero data storage: Doesn't store searches or personal information

Family-friendly: Built-in filters block adult content

Semantic search: Understands meaning behind queries

Anonymous ads: Serves ads based on search terms, not user profiles

Swisscows appeals to privacy advocates and families wanting safe search without tracking.

Best For: Privacy-focused users and families seeking safe search environment.

Pros:

Swiss data protection laws

No tracking or data storage

Family-friendly by default

Semantic understanding of queries

Cons:

Smaller index limits result quality

Less comprehensive than major engines

Limited adoption outside privacy-focused communities

12. Mojeek

Monthly Users: Not publicly disclosed

Market Share: Independent crawler niche player

Mojeek runs its own independent crawler and index—no Bing, no Google. Founded in 2004, it's one of the few search engines building infrastructure from scratch.

The platform prioritizes privacy and algorithmic transparency, showing users how results are ranked.

Key Features:

Independent index: Own crawler, own algorithm

No tracking: Doesn't store search data or build user profiles

Algorithmic transparency: Explains ranking factors

Unbiased results: No personalization or filter bubbles

UK-based: Operates under British privacy regulations

Mojeek appeals to users who want true independence from Google/Bing infrastructure, even if that means accepting less comprehensive results.

Best For: Users prioritizing independence and transparency over comprehensive coverage.

Pros:

Truly independent infrastructure

Strong privacy protections

Algorithmic transparency

No filter bubbles

Cons:

Smaller index means limited results

Less accurate for complex queries

Minimal market share

13. You.com

Monthly Users: Growing AI search platform

Market Share: Emerging AI-first player

You.com combines traditional search with AI assistance, delivering personalized results without invasive tracking. The platform uses AI to summarize information, answer questions, and filter results based on user preferences.

Key Features:

YouChat: AI assistant answering questions conversationally

App integration: Connect tools like GitHub, Twitter, Reddit for personalized results

Custom filters: Choose which sources appear in results

Privacy mode: Private searches without tracking

Developer tools: API access for building on You.com

You.com targets power users who want customization without surveillance.

Best For: Tech-savvy users wanting AI assistance with customization.

Pros:

AI assistant provides direct answers

App integrations create personalized experience

Privacy mode available

Growing developer ecosystem

Cons:

Smaller index than major players

Full features require account creation

Still establishing market presence

14. Gibiru

Monthly Users: Not publicly disclosed

Market Share: Privacy-focused niche player

Gibiru markets itself as the "uncensored anonymous search engine." It delivers Google search results through an encrypted proxy, hiding your identity from Google.

Key Features:

Anonymous Google results: Access Google's index without tracking

No cookies: Doesn't store cookies or search history

Encrypted searches: SSL encryption protects queries

Fast results: Claims faster load times than mainstream engines

Gibiru appeals to users wanting Google's coverage with privacy protection.

Best For: Users seeking anonymous access to Google's index.

Pros:

Google results without tracking

No cookies or history storage

Encrypted connections

Simple interface

Cons:

Still dependent on Google

Limited adoption

Fewer features than competitors

15. Searx

Monthly Users: Not publicly disclosed (decentralized)

Market Share: Open-source privacy option

Searx is an open-source metasearch engine aggregating results from multiple sources without tracking users. It can be self-hosted, giving users complete control over their search infrastructure.

Key Features:

Open source: Code is publicly auditable

Self-hosting: Run your own instance

Metasearch: Aggregates results from 70+ engines

No tracking: Doesn't store searches or user data

Customizable: Choose which engines to query

Searx appeals to technically sophisticated users wanting maximum control and privacy.

Best For: Tech-savvy users who want to host their own search or maximum privacy.

Pros:

Complete control through self-hosting

Open-source transparency

Aggregates multiple engines

No corporate owner

Cons:

Requires technical knowledge

Public instances may be unreliable

Setup complexity deters casual users

How Keytomic Helps You Optimize for Multiple Search Engines

Here's the thing most SEO tools won't tell you: optimizing for Google alone leaves traffic on the table.

Bing captures 4.22% of global searches, that's 1.2 billion daily queries. DuckDuckGo reaches 100 million privacy-conscious users daily. Yahoo handles 2.75 billion monthly searches. AI engines like Perplexity process 30 million queries daily. These platforms use different ranking signals, prioritize different content types, and serve audiences with distinct search behaviors.

Keytomic automates keyword research across multiple engines, identifies ranking opportunities beyond Google, and generates optimized content that performs across traditional and AI search platforms. The platform's multi-engine approach helps agencies and content teams capture visibility wherever their audience searches, not just where Google sends them.

For marketers managing portfolios across Bing, privacy engines, and AI platforms, Keytomic's unified workflow eliminates the need to juggle separate tools for each channel. Keyword clustering identifies semantic relationships that work across engines. Auto-publishing handles multi-CMS distribution. AI visibility tracking monitors how your content appears in ChatGPT, Perplexity, and other generative platforms.

When searching across a dozen viable platforms, automation becomes the only scalable response. Keytomic handles the repetitive work: research, optimization, publishing, tracking, so you focus on strategy instead of spreadsheets.

Frequently Asked Questions

What is the best alternative to Google in 2026? Bing is the closest alternative for mainstream users, with 4.22% global market share and 100 million daily active users. For privacy, DuckDuckGo leads with 100 million daily searches. For AI-powered answers, Perplexity processes 30 million daily queries. The "best" alternative depends on your priorities: scale, privacy, AI, or regional coverage.

Is Bing really a viable alternative to Google? Yes. Bing processes 1.2 billion daily searches, serves 100 million daily active users, and generates $15.6 billion in annual ad revenue. Its AI Copilot integration drove market share from 3.51% to 4.61% in one year. For advertisers, Bing offers 30% lower costs per click than Google Ads with comparable conversion rates.

Which search engine doesn't track you at all? DuckDuckGo, Brave Search, Startpage, and Swisscows offer zero tracking. DuckDuckGo doesn't store search history or profile users. Brave Search operates its own independent index without surveillance. Startpage delivers Google results anonymously. Each handles privacy differently—choose based on whether you prioritize independent infrastructure or Google-quality results.

What search engine do privacy advocates use? DuckDuckGo leads with 100 million daily searches. Brave Search attracts tech-savvy users with its independent index. Startpage appeals to those wanting Google results without tracking. The privacy community is fragmented across multiple engines, each offering different trade-offs between privacy, result quality, and features.

How does Bing's market share compare to Google? Bing holds 4.22% global market share versus Google's 90.04%. In the U.S., Bing captures 8.78% while Google holds 85.07%. On desktop devices, Bing reaches 11.96% globally and 16.75% in the U.S. Bing's share has grown steadily for five consecutive years, primarily driven by AI integration and default Windows placement.